Product

Mobile banking service allows bank customers to make financial transactions remotely using a smartphone or tablet.

Here we describe the product, a mobile application for online banking, that is already used by several major European banks. It's developed by the banking software division of Noventiq Group.

We, at Belitsoft, can quickly implement and customize this banking product to meet the specific requirements of your financial institution.

The advantage of this banking solution lies in the possibility of its deep customization, as well as in the availability of a qualified team of bank app developers to perform this task.

Core Features

At its core, this app includes several must-have basic functions for online banking, that can be quickly implemented for the mobile application of any bank, significantly reducing development costs. Additional functions are available for individual requests to solve unique, leading-edge challenges.

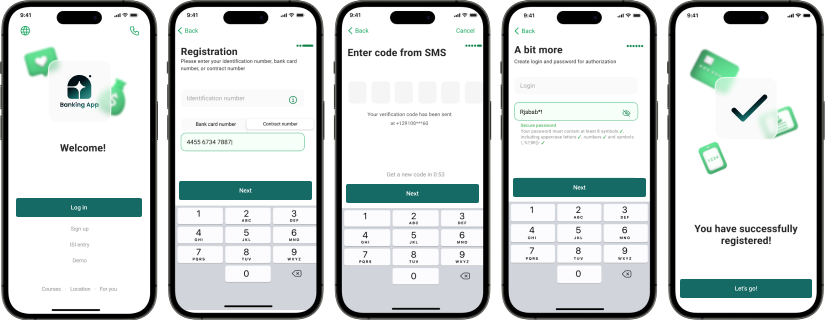

Convenient clients onboarding

The process takes no more than several minutes and consists of the following steps: downloading the mobile app, entering personal ID from passport to confirm having banking products (card, account, deposit, credit), entering SMS code, creating login and password.

Safe Authorization

If a device has biometric sensors, the mobile banking app can use biometric authentication (Face ID). It minimizes the risk of identity fraud. Otherwise, it relies on PIN.

Security

All passwords are hashed (one-way cybersecurity technique) before storing them in a database. To ensure that all data passed between the device and web server remains private and secure, SSL Pinning is enabled. If users aren't active in the app for a preconfigured amount of time, the system automatically logs them out.

The app is integrated with the device's keychain or secure storage (like Apple Keychain on iOS) to securely store and retrieve sensitive information, such as login credentials or authentication tokens.

Source code obfuscation is implemented. Attackers can't decompile the app and understand how to hack it. Protection techniques against code injection and repackaging are added as well.

Payments Management

Money transfers and payments are available at the fingertips. Clients can automate all their monthly payments, pay off loans and mortgages, or share a bill from a restaurant with friends.

By default, the product does not have integrations like PayPal, etc., however, our developers can easily add them.

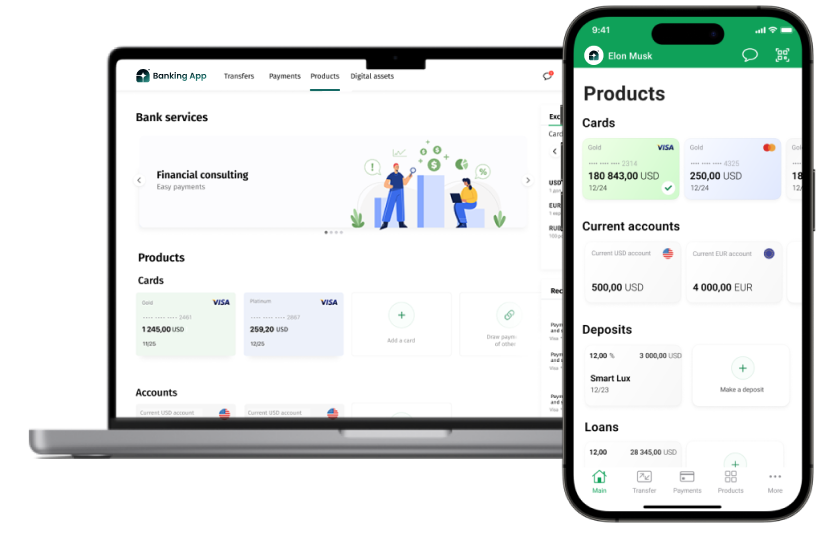

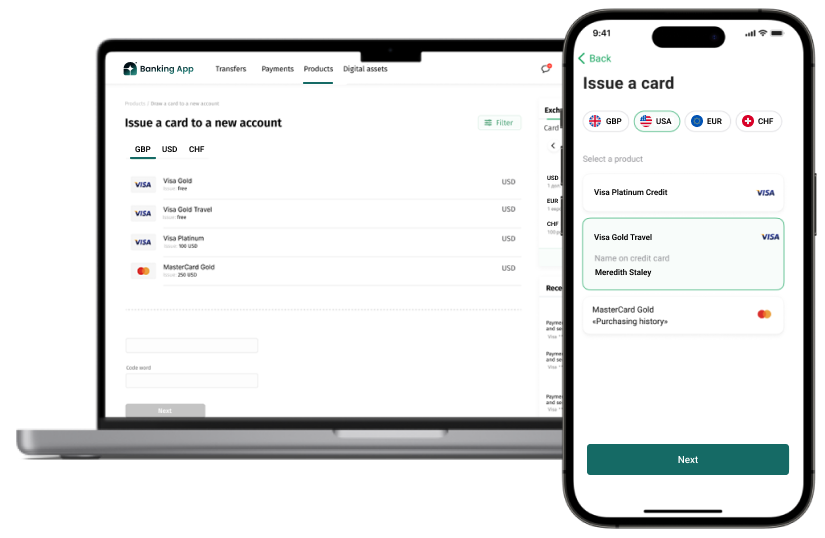

Cards Management

Directly in the app, banking clients can do habitual things like checking their balance or viewing and changing their PIN codes. They can swipe through their existing cards and apply for a new card.

The interface is convenient enough to immediately lock the card in several clicks if they lose it or it has been stolen. If they get the card back, they can unlock it too without contacting the bank.

Customers can create different virtual cards for an array of purposes (e.g., one for subscriptions, one for shopping) directly in the app. It's a widely used option to make online shopping secure because if a website gets hacked, the main card details aren't exposed. It's easy to configure spending limits and pause or cancel virtual cards. Users often add such cards to Apple Pay or Google Pay digital wallets for in-store purchases.

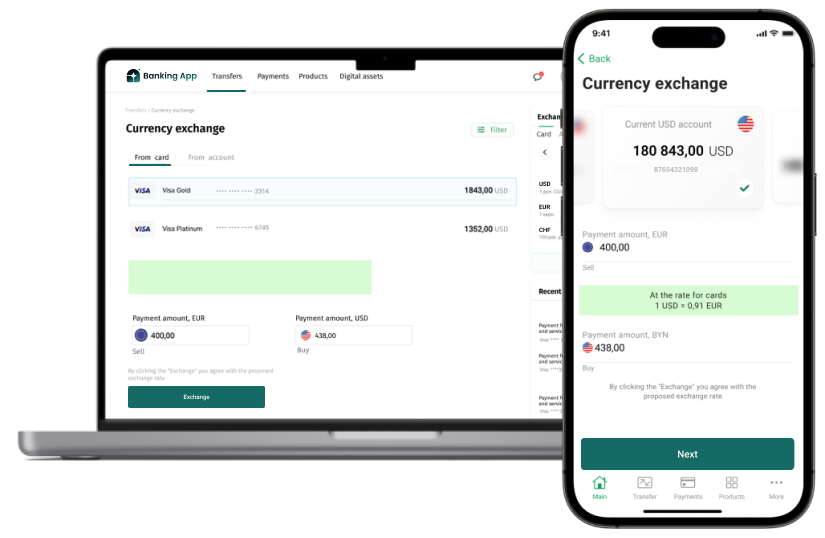

Change Currency in Bank App

The bank apps let users have different "pockets" or accounts for various currencies like dollars, euros, pounds, etc.

When a client wants to exchange money, they select the currency to change from and the currency to change to, for example, dollars to euros. They type in the amount of money to exchange and can immediately see how much of the new currency they'll get. If they are happy with the rate, they can press a button to confirm the exchange.

The new currency is then put into the other account. The transaction is added to the history.

Transaction Management

The transaction history is available to look up. Users can set their own limits for cash withdrawals, and daily/weekly/monthly transaction limits, etc.

To repeat a money transfer to someone, users don’t have to input the recipient data again due to saved templates.

The app sends notifications about the payments made.

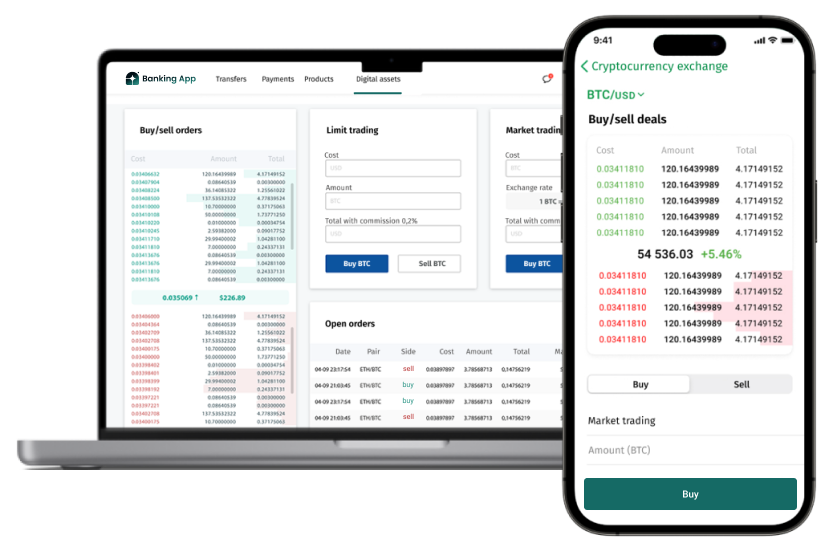

Crypto Trading and Exchange

The mobile banking app lets users trade digital currencies like Bitcoin. They can either buy or sell instantly at the current price or set a price they want to buy or sell at. The app shows a list of orders and the current exchange rate for currency pairs like BTC/USD.

Ways to Customize

Mobile banking usage is increasing, while the popularity of branch banking is decreasing. The mobile app can lower servicing costs, improve customer satisfaction, enhance service accessibility, facilitate client outreach, sell more to existing clients, and attract small businesses.

It is impossible to create a ready-made banking application that is a one-size-fits-all, so customization is always needed. To capture customer attention, banks come up with products and features that will be available only in their application. These can be a major new functionality or small but critical improvements to existing functions. Here are some ideas for what can be refined for a specific financial institution by individual order.

It's possible to use the app created with either cross-platform or native technologies. As for a native development option, an iOS mobile banking app is usually built using Swift, XCode, and the iOS SDK, while an Android app is created with Java/Kotlin, Android Studio, and the Android SDK.

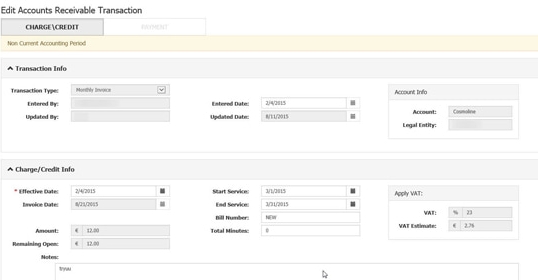

Transactions

- The number of reward points a client earned for each can be displayed along transaction history records.

- "Travel Notification" option can be implemented to inform the bank that the client is outside the country to decrease restriction risks due to suspicious transactions policy that leads to block the card.

- Cardless cash withdrawals may be possible after integration of the smartphone app with an ATM via app-generated codes (QR or a string of numbers) or NFC.

- The remote deposit capture feature can be developed to deposit a check without going to a bank.

Notifications

The app may send different types of push notifications:

- personalized offers based on the customer’s spending history;

- GPS-based notifications that promote special offers at partner locations if clients are nearby;

- requests for authorization of scheduled payments when it’s time.

Budget Management

A dashboard with income and expenses for a selected period is a gold standard for a mobile banking app. Monthly budget planning by category may be an extra feature to control spending.

- A colorful pie chart shows the share of each category. Users can track their progress, compare it to a previous period, and forecast expenses. They may set savings goals (like for a trip or a new car).

- Customers let the app know how much money they make each month. Every time they use their bank card, the app automatically records it. If they're close to overspending in a tracked category, the app sends an alert. Over time, the app shows them patterns in their spending.

Location Tracking

The mobile app may show the path to the closest point of interest. It can be a bank's ATM, banking center, or an outlet of a loyalty program partner in large shopping malls. The on-screen navigator reads the current location, if the customer allows it, and directs with an arrow.

Customer support

Common questions from mobile app users can be accurately answered by the AI chatbot, which can be additionally integrated. If a request is complex due to many nuances, then bank personnel receive the redirected customer data for a more personal touch.

Customers can do their favorite things with the app using their voice, thanks to integrations with voice assistants.

User-friendly, intuitive schedulers connect customers to the right person they need at the time and location that suits them for reasons like mortgage or auto loan assistance, investment planning, general service requests, or technical support. This option often increases NPS scores.

The application can be integrated with an anti-fraud system for improved security.

API integration

To cut costs, we can integrate stable, secure and actively supported ready-to use third-party services that enrich mobile apps with customer data analytic, in-app notifications, user verification, and in-app messaging and services that help with geography-based KYC/AML verification procedures for new app users.

We suggest using as little third-party code as possible in the mobile banking app and only from trustworthy suppliers who develop their product in a way that does not break the app. Before integration, we test the code for vulnerabilities. We also check if leaks of personal data to third parties are possible.

Legal

The necessary standards can be followed: PCI DSS (across the globe), CCPA (California, USA.), GDPR and PSD2 (EU), etc.

Related cases

Recommended posts

Our Clients' Feedback

.png)

.png)

Belitsoft has been the driving force behind several of our software development projects within the last few years. This company demonstrates high professionalism in their work approach. They have continuously proved to be ready to go the extra mile. We are very happy with Belitsoft, and in a position to strongly recommend them for software development and support as a most reliable and fully transparent partner focused on long term business relationships.

Global Head of Commercial Development L&D at Technicolor