Client

Our Client is a private financial institution with a firm presence in the banking sector for over 3 decades. They have built an extensive global network of correspondent banks and have accumulated assets of over $300 billion as of 2023.

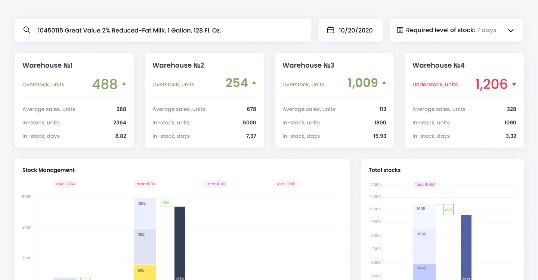

For data-driven and informed decision-making, both in internal processes and with customers, the enterprise relies on the custom Business Intelligence system.

The software ingests and processes gigabytes of data related to banking operations and client profiles, presenting it through PowerBI dashboards to identify trends, mitigate risks, enhance customer experience, and optimize operations.

Challenge

The legacy architecture of the analytical software, built years ago, was causing a snowball effect of issues, disrupting the enterprise's daily business operations.

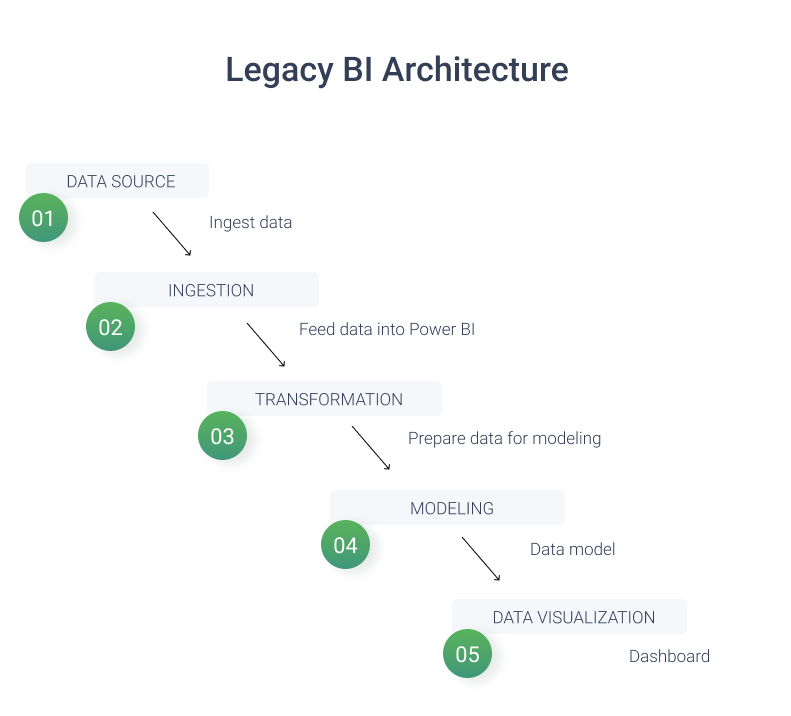

Power BI pulls data from the bank's transactional database. Then, the data is prepared and structured for analysis. Finally, BI dashboards display the results in user-friendly dashboards

Limits in functionality as a barrier to detecting critical risks and insights

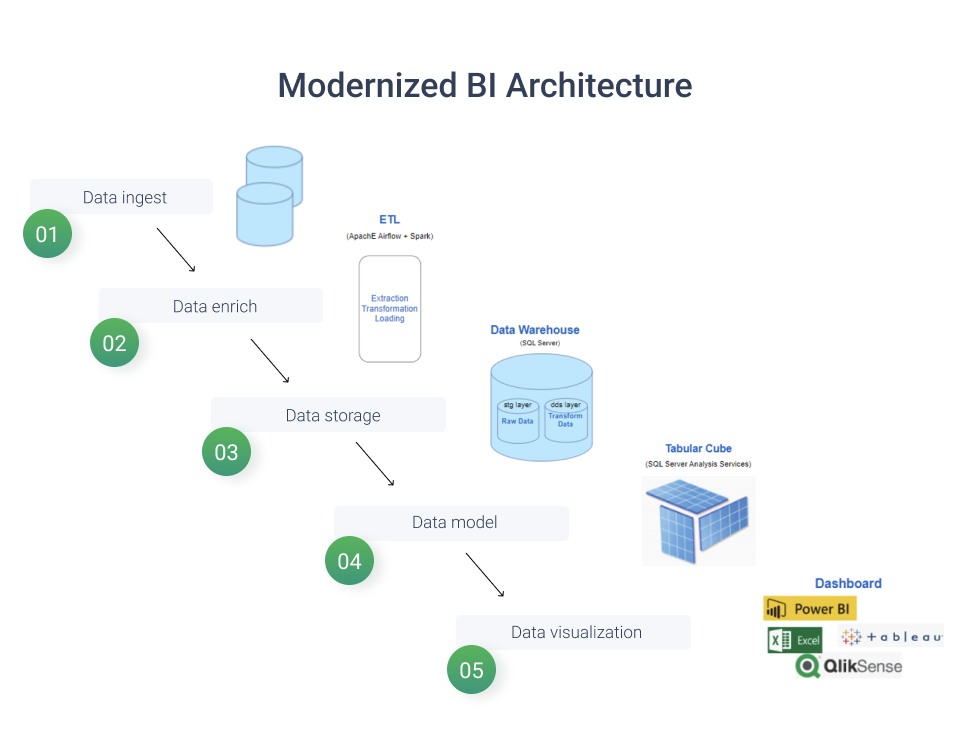

While handling data directly in PowerBI was adequate for basic data analysis tasks - such as extracting data from a single source like an Excel file or a database, performing fundamental data transformations, and creating visualizations for simple analyses – it fell short in more complex scenarios.

Specifically, financial analytics could not develop custom algorithms to perform complex data operations, like gathering data from multiple sources simultaneously, merging and aggregating data from different branches, executing non-standard calculations for fraud detection, and many more.

Slow performance impeding the work of bank employees and analytics

The bank faced performance bottlenecks in its operations and analytics due to using a single database for both routine tasks and data analysis. This database, originally designed for small, real-time transactions, and couldn't handle the large amounts of data and complex calculations needed for tasks like customer segmentation. Frequent performance issues and system crashes resulted from this limitation, which made the bank less efficient and unable to scale up in data-heavy situations.

Challenges in scalability owing to data source constraints

The financial analytics system had a linear setup, taking data straight from the transactional database into Power BI, but it had a 2 GB file size limit. While it was sufficient for standard customer transactional data, it proved inadequate for broader market trends analysis. As the bank's customer database grew, the data size frequently exceeded this limit, causing operational and scaling challenges, especially in fraud detection scenarios.

Limited in-depth reporting due to relying only on one BI visualization tool

The bank heavily relied on Power BI as its sole BI tool for data visualization, which limited its analytical capabilities for various roles within the organization, including top managers and analysts. While Power BI is suitable for high-level reporting, financial analytics might need to perform detailed analysis like Excel transformations. This one-size-fits-all approach reduced flexibility and hindered effective data analysis across different roles within the bank, impacting decision-making and reporting capabilities.

Solution

Process

Results

In Numbers

Related cases

Recommended posts

Our Clients' Feedback

.jpg)

Belitsoft has been the driving force behind several of our software development projects within the last few years. This company demonstrates high professionalism in their work approach. They have continuously proved to be ready to go the extra mile. We are very happy with Belitsoft, and in a position to strongly recommend them for software development and support as a most reliable and fully transparent partner focused on long term business relationships.

Global Head of Commercial Development L&D at Technicolor